Ethiopia Entrepreneurial Ecosystem Mapping

Preview & Key Insights

Methodology

ANDE has a rigorous process for validating survey responses to ensure all the organizations have provide direct support to entrepreneurs and SMEs in Ethiopia.

Once reviewing the data and then conducting desk research based on stakeholder input, the final dataset include 140 organizations and 169 resources.

This is a living mapping, meaning these numbers will fluctuate as new organizations are identified or new programs are formed.

ANDE has published 20+ ecosystem mappings to date, which have been used to inform both policy and practice.

We began the process in December 2023 and ended in September 2024. The data reflects a snapshot of this time period.

The ANDE research team and local expert consultant, Shega, scanned online resources and consulted our East Africa chapter staff to generate an initial list of ecosystem stakeholders.

The research team designed the mapping survey and distributed it to all identified ecosystem stakeholders.

After analyzing the initial results, ANDE and Shega presented preliminary results to ecosystem stakeholders to confirm that the findings resonated and identify stakeholders missing from the analysis.

Data was collected for all additional stakeholder who did not complete the survey.

ANDE will publish an online directory of organizations active in Ethiopia's ecosystem alongside a key insights report on September 24, 2024.

This nine-month process resulted in a database of 140 entrepreneurial ecosystem stakeholders in Ethiopia.

KEY FINDINGS

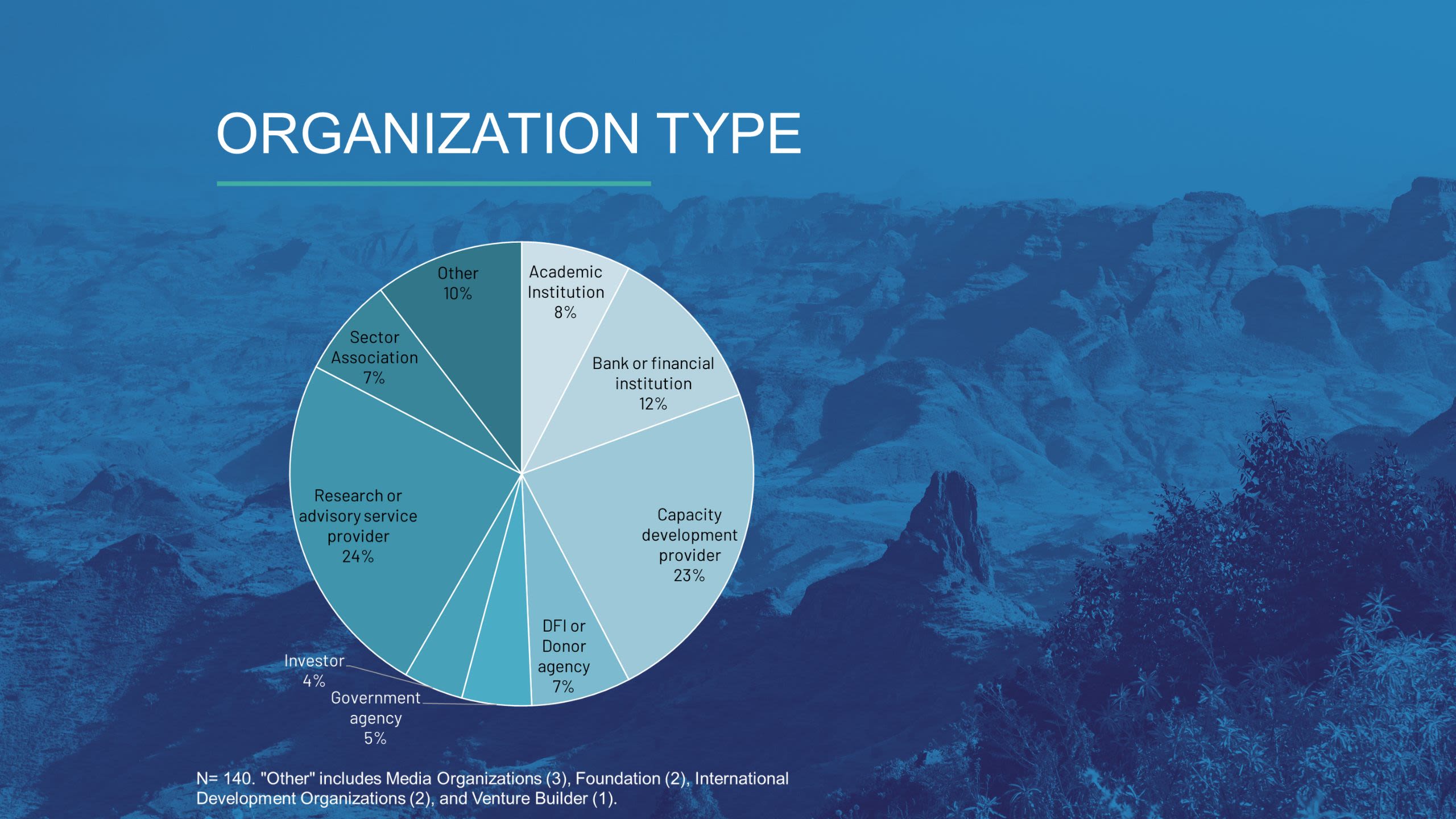

The most common types of organizations actively supporting entrepreneurs in Ethiopia include:

1. Research/advisory service providers (e.g. business consultancies)

2. Capacity development providers (e.g. training centers, non-profit accelerators/incubators).

The organizations identified in the mapping provide 169 distinct resources for entrepreneurs in Ethiopia.

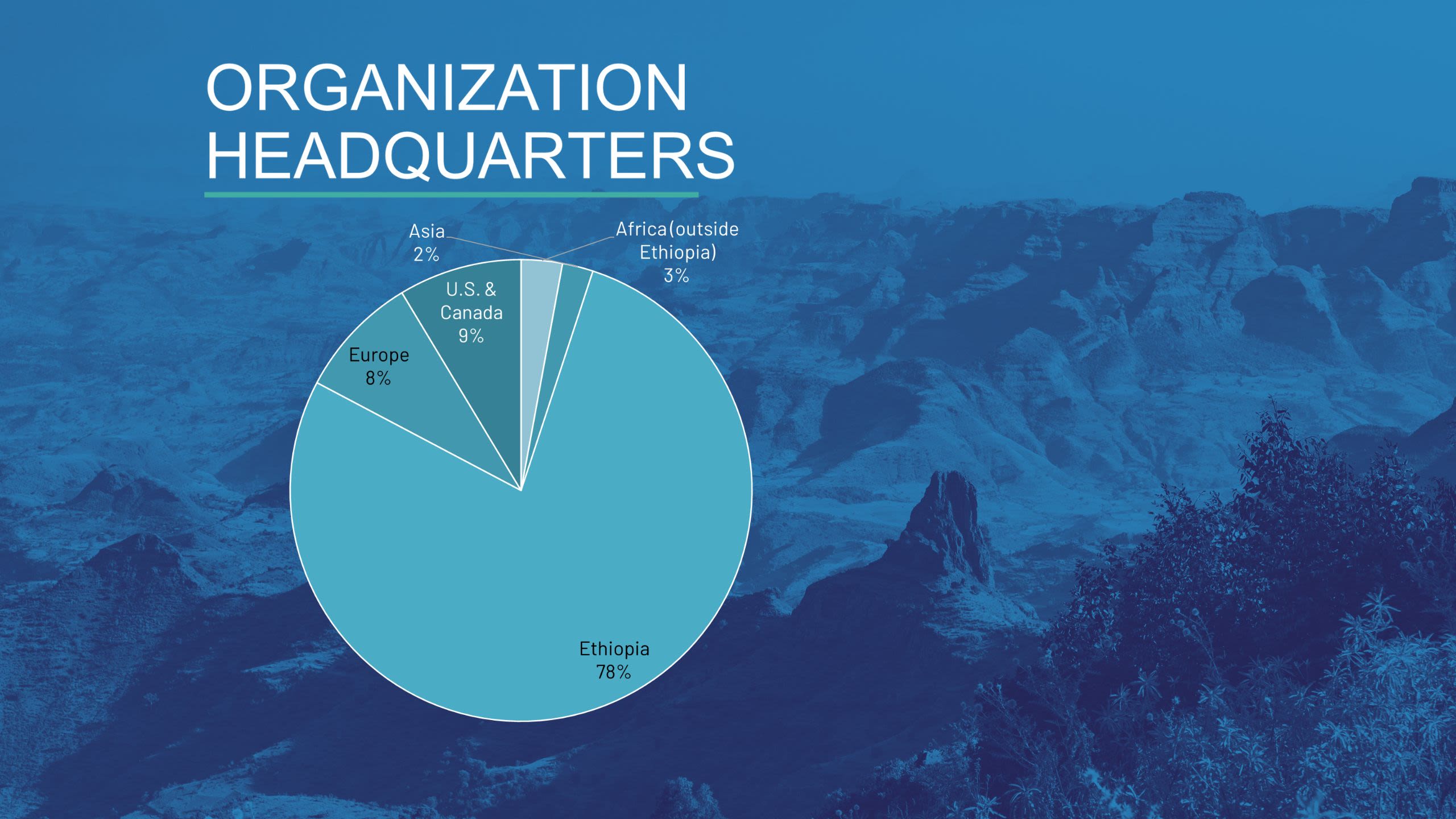

More than 75% of the organizations are headquartered locally.

Within Ethiopia, 85% are based in Addis Ababa.

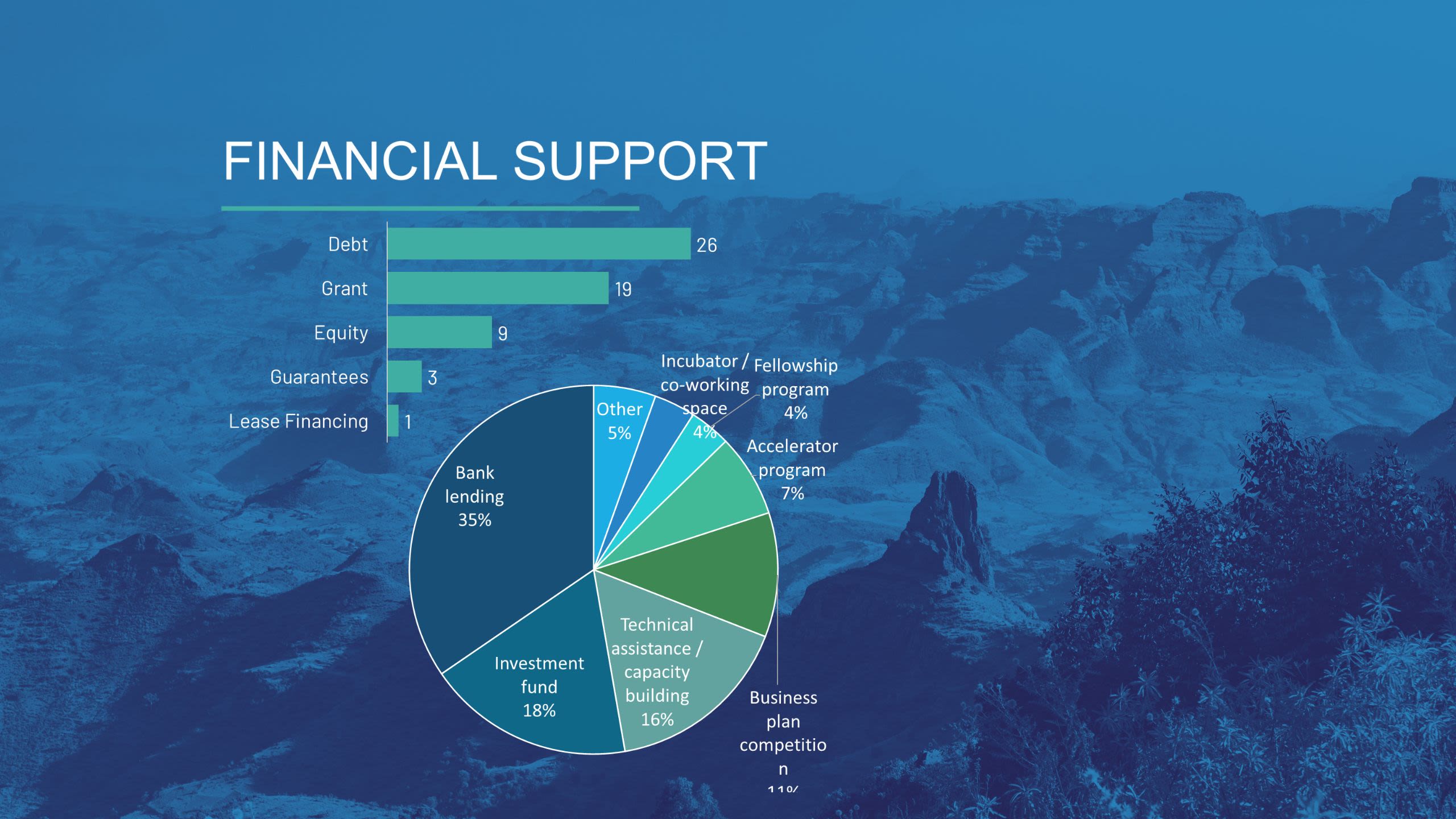

Among the 112 primarily nonfinancial resources, 16 (14%) also include financial support, most commonly in the form of grants.

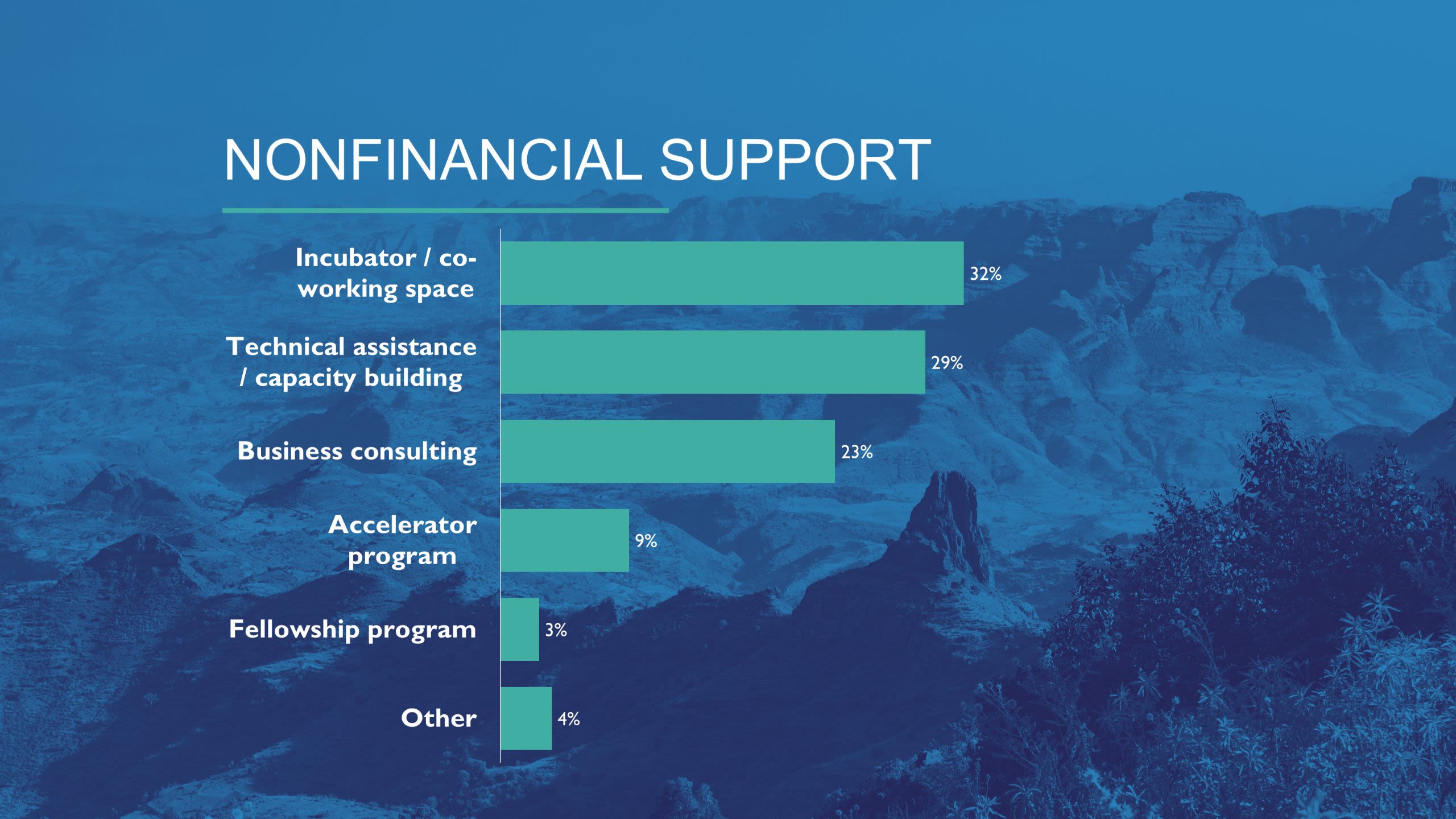

The most common resources include incubation/co-working space and technical assistance/training, followed by business consultancies.

Bank lending is the most common form of investment support.

Only 11 investment funds were identified, about half of which are based outside of Ethiopia.

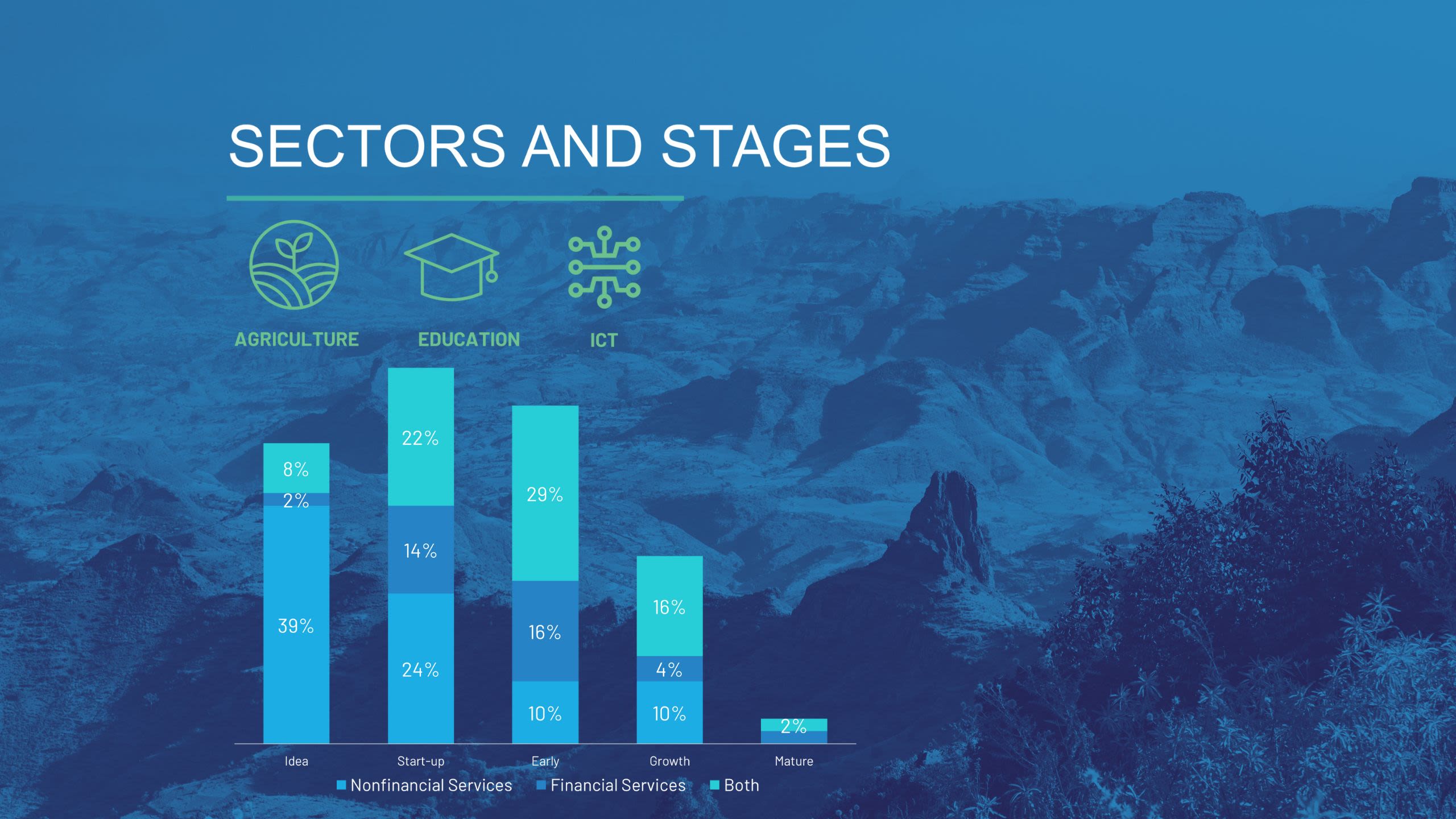

The most commonly supported sectors include Agriculture & Food (57%), Education (24%), and Information & Communication Technology (18%), followed closely by Financial Services and Health (each at 16%).

Most of the support available to idea-stage enterprises is in the form of incubators, co-working spaces, and other technical assistance programs.

Challenges & Opportunities

Challenges

- Poor awareness of the business advisory market among Ethiopian businesses.

- Skill gap in understanding local business needs and providing tailored services.

- Financial resource constraints limit scaling and expansion of initiatives.

- Local advisory players may not be competitive against foreign entrants.

- Inflation and conflict affect stability and operations.

- Misconceptions about training programs yielding financial rewards lead to training fatigue.

Opportunities

- Growing demand for business advisory services as Ethiopia's economy and private sector expand.

- Increasing government interest in private sector advisory services.

- Underdeveloped market for business advisory services presents a significant growth opportunity.

- Potential for local advisory service providers to learn from foreign players and improve service quality.

- Reform initiatives related to regulatory frameworks and new startup-focused initiatives.

Look out for the complete database and more key insights on September 24th.

The full mapping report will be available for download at www.andeglobal.org.